How Agentic AI Powers Data-Driven Compliance in Finance

The Compliance Paradox

Financial institutions face an unprecedented regulatory burden. Anti-Money Laundering (AML) protocols, Know Your Customer (KYC) requirements, Basel III capital standards, GDPR privacy mandates, and Dodd-Frank oversight have created a labyrinth of obligations that grows more complex each year.

Traditional compliance operates reactively. Teams follow rule-based checklists, manually review flagged transactions, and scramble to meet reporting deadlines. The work is labor-intensive, expensive, and prone to human error. Yet here's the paradox: as regulations multiply, so does the data available to ensure compliance. Financial institutions now have access to transaction histories, communication logs, external datasets, and behavioral patterns that could dramatically improve compliance outcomes. The problem? Humans simply can't process it all fast enough.

Agentic AI transforms this equation. Instead of treating compliance as a manual policing function, it becomes a proactive, data-driven intelligence layer that works continuously, learns from every interaction, and scales effortlessly across regulatory domains.

The Shift from Rule-Based to Agentic Compliance

Traditional compliance systems operate like glorified if-then statements. They flag transactions above certain thresholds, scan for blacklisted entities, and trigger alerts based on predefined patterns. These systems are rigid. When regulations change or new fraud tactics emerge, human teams must manually update the rules.

Agentic AI systems work differently. They reason dynamically, adapting as regulations evolve and business contexts shift. These autonomous agents continuously scan transactions, communications, and external datasets, searching for anomalies that rule-based systems would miss.

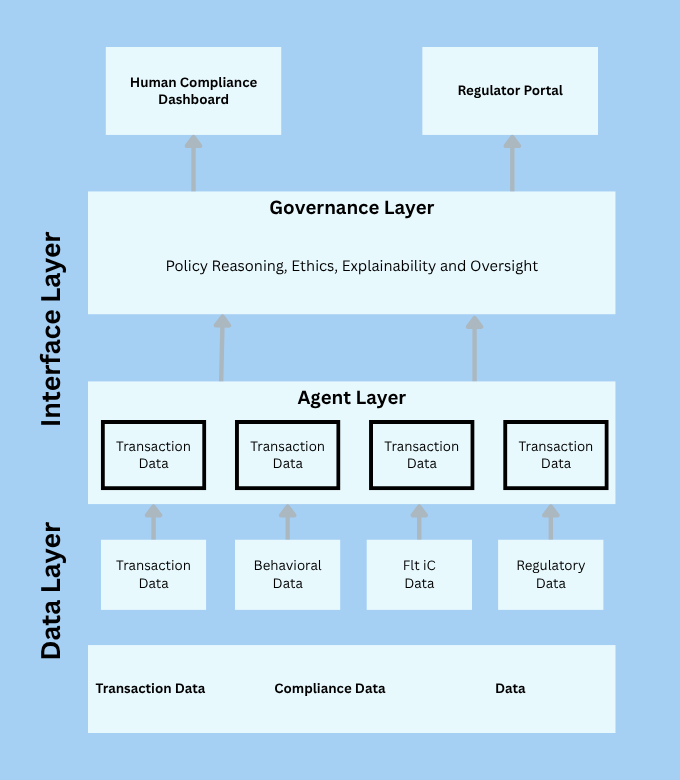

The real power emerges from multi-agent coordination. Rather than a single monolithic system, specialized agents handle distinct domains. A fraud detection agent monitors transaction patterns. A data privacy agent ensures GDPR compliance. A reporting agent compiles audit documentation. These agents share context, collaborate on complex investigations, and escalate issues to human supervisors when needed.

Perhaps most importantly, these systems learn continuously. Each false positive teaches the model to refine its detection logic. Each confirmed violation strengthens pattern recognition. Over time, accuracy improves and alert fatigue decreases.

Core Capabilities: Data-Driven Compliance Intelligence

Contextual Understanding

Agentic systems excel at interpreting unstructured data. They read emails, analyze chat logs, and review contracts not just for keywords but for intent and tone.

Consider insider trading detection. Traditional systems flag trades by employees with access to material information. Agentic systems go further, analyzing communication patterns, meeting schedules, and subtle linguistic cues that suggest inappropriate information sharing. They detect when a casual conversation crosses the line into coordination.

Similarly, sanction screening becomes more sophisticated. Rather than simple name matching, agents understand corporate ownership structures, identify beneficial owners hidden behind shell companies, and flag transactions that attempt to circumvent restrictions through layered intermediaries.

Predictive and Preventive Analysis

The most powerful compliance is preventive. Agentic AI performs real-time risk scoring using behavioral and transaction data, calculating the likelihood that an account or transaction will result in a compliance breach.

In AML, agents recognize emerging patterns before they mature into full-fledged schemes. They notice when transaction flows mirror known laundering typologies, when account behavior shifts suddenly, or when multiple accounts exhibit coordinated activity. The system doesn't just react to violations; it forecasts them.

Autonomous Reporting and Auditability

Regulatory reporting consumes enormous resources. Teams gather data from disparate sources, reconcile inconsistencies, and compile narratives that satisfy jurisdiction-specific requirements.

Agentic systems automate this process end to end. They maintain complete audit trails, generate narrative explanations for every decision, and produce regulatory reports formatted to exact specifications. Integration with RegTech ecosystems and enterprise data lakes ensures that every claim is traceable to its source.

Crucially, this automation doesn't create a black box. Every recommendation, every alert, and every report comes with a clear explanation of the reasoning behind it.

Human-in-the-Loop Oversight

Agentic compliance doesn't eliminate human judgment; it elevates it. Compliance officers transition from rule enforcement to risk orchestration. Rather than reviewing every transaction manually, they supervise digital agents, approving recommendations, refining detection logic, and retraining models based on regulatory feedback.

This partnership leverages the strengths of both human and machine intelligence. Agents handle volume, pattern detection, and consistency. Humans provide strategic judgment, ethical reasoning, and accountability.

Agentic AI in Action: Key Use Cases in Finance

Anti-Money Laundering (AML)

AML compliance requires tracking vast networks of cross-border transactions, identifying suspicious patterns, and reporting them to regulators. Agentic systems monitor these flows continuously, flagging activities that deviate from expected behavior. When regulators provide feedback on reports, the agents learn and adjust their detection criteria accordingly.

Know Your Customer (KYC)

Customer onboarding involves validating identity documents, checking sanction lists, and assessing risk profiles. Agentic KYC agents validate data across multiple authoritative sources, detect forged or altered documents, and continuously update risk assessments as customer behavior evolves or regulatory requirements change.

Transaction Monitoring

Financial crime grows more sophisticated each year. Fraudsters layer transactions, exploit timing windows, and disguise patterns to evade detection. Pattern recognition agents analyze transaction sequences across time, accounts, and channels, identifying subtle shifts that indicate coordinated fraud or insider trading attempts.

ESG Compliance

Environmental, Social, and Governance (ESG) reporting has moved from voluntary disclosure to regulatory requirement. Autonomous ESG audit agents track sustainability metrics, verify data accuracy across supply chains, and ensure that reported figures are traceable to underlying sources. They flag discrepancies, identify greenwashing risks, and maintain the detailed documentation that stakeholders demand.

Regulatory Reporting

Different jurisdictions impose different reporting requirements. MiFID II in Europe, FATCA in the United States, and local regulations in dozens of other markets create a complex compliance matrix. Reporting agents understand these jurisdiction-specific rules and auto-generate compliant reports with the correct formatting, timing, and content requirements.

Data Infrastructure for Agentic Compliance

Effective agentic compliance requires a robust data foundation. A unified data fabric provides seamless access to both structured and unstructured data across organizational silos. This integration breaks down the barriers between transaction systems, communication platforms, and external data sources.

Trust and lineage matter immensely. Every data decision must be explainable and traceable for auditors. Agentic systems maintain detailed provenance records, documenting where data originated, how it was transformed, and which rules or models influenced each decision.

Legacy system integration poses a practical challenge. Few institutions can replace their core banking platforms overnight. Connectors, APIs, and digital twins bridge these gaps, allowing agents to access data locked in older systems without requiring wholesale replacement.

Security and privacy guardrails are non-negotiable. Policy enforcement agents ensure that sensitive data is encrypted, appropriately anonymized, and handled in compliance with data residency laws. These agents monitor access patterns, detect unauthorized queries, and enforce least-privilege principles across the compliance infrastructure.

Building a Digital Compliance Workforce

Designing an effective agentic compliance system requires a structured approach. Organizations should develop specialized agents for distinct functions: an AML agent focused on transaction monitoring, a data quality agent that ensures information accuracy, an audit trail agent that maintains documentation standards.

Governance must be embedded by design. Ethical and legal reasoning should be woven directly into agent behavior models, not added as an afterthought. Agents should understand not just regulatory requirements but the principles behind them.

Continuous training and testing are essential. Synthetic data and regulatory simulations allow organizations to stress-test their agents, exposing them to rare scenarios and adversarial tactics without waiting for real violations to occur.

Success metrics should include false positive reduction (fewer unnecessary alerts), compliance cost savings, and audit turnaround time. But organizations should also track qualitative measures: Are agents providing useful explanations? Do compliance officers trust their recommendations? Are regulators satisfied with the documentation?

Agentic Compliance Architecture

Challenges and Ethical Guardrails

Algorithmic transparency remains a critical concern. Regulators need to understand how agents reach their conclusions. Black-box models, no matter how accurate, create accountability problems. Explainable AI techniques must be standard practice, not optional features.

Bias and fairness require constant vigilance. Credit decisioning agents can inadvertently discriminate against protected groups. Fraud detection models can develop disparate impact across demographic categories. Regular bias audits, diverse training data, and fairness constraints in model optimization help mitigate these risks.

Regulatory acceptance poses a practical challenge. Many jurisdictions require human accountability for compliance decisions. Organizations must balance the efficiency gains from automation with the regulatory requirement that humans remain in control. Clear documentation of human oversight and approval workflows helps bridge this gap.

Cyber resilience becomes more critical as compliance systems become more autonomous. Agent communication channels and contextual memory stores are attractive targets for adversaries. Protecting these systems from manipulation, poisoning attacks, and unauthorized access requires security-by-design principles and continuous threat monitoring.

The Future: Autonomous Compliance Ecosystems

The next frontier is collaborative compliance. Imagine networks of agents exchanging insights across institutions within secure enclaves. A pattern emerging at one bank triggers alerts at others. Collective intelligence improves detection rates while preserving competitive confidentiality.

Regulatory collaboration models will evolve. Agents could serve as real-time liaisons between firms and regulators, providing continuous assurance rather than periodic reports. Regulators gain visibility without imposing excessive reporting burdens. Firms demonstrate compliance proactively rather than waiting for examinations.

The ultimate vision: compliance as a living, adaptive system. Not a fixed set of rules but an intelligent layer that continuously aligns with evolving global standards. As regulations change, agents update their reasoning. As new risks emerge, the system learns and adapts. Compliance becomes less about reacting to violations and more about maintaining continuous alignment with regulatory intent.

Compliance as a Competitive Advantage

For too long, financial institutions have treated compliance as a cost center. A necessary burden. A drag on innovation and profitability.

Agentic AI flips this narrative. Data-driven compliance becomes a trust accelerator. Customers, investors, and partners gain confidence from knowing that an institution maintains rigorous, continuous oversight. Regulatory violations damage brand value, erode customer trust, and invite costly enforcement actions. Effective compliance protects all of these assets.

Financial leaders should invest in agentic compliance infrastructure now. Regulatory velocity continues to accelerate. The gap between manual compliance capabilities and regulatory expectations widens each year. Organizations that build sophisticated compliance systems today will have a decisive advantage tomorrow. They'll spend less on compliance labor, face fewer violations, respond faster to regulatory changes, and earn the trust that increasingly drives competitive differentiation in finance.

The question isn't whether agentic AI will transform compliance. It's whether your institution will lead that transformation or struggle to catch up.